Bank Risk, Monetary Transmission, and Macroprudential Policy 銀行のリスク,金融政策の伝播,およびマクロプルーデンス政策の分析

日時:2021年5月20日 (木) 13:00-14:30

場所: Zoomでのオンライン開催

スピーカー:五十嵐洋介 (北海道大学経済学研究院・准教授)

参加者:14名

アブストラクト:

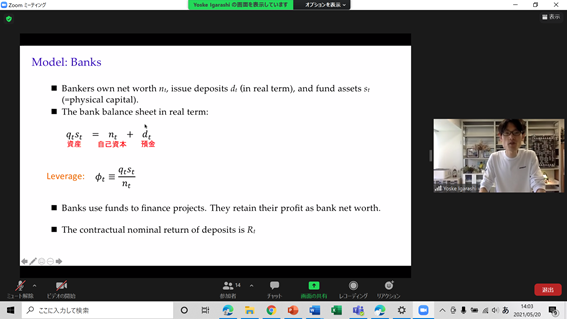

This paper investigates the influence of bank default and leverage

constraints in monetary and macroprudential policy prescriptions. For

that purpose, we build a New Keynesian model with banks who channel

funds from households to firms. They face endogenous leverage

constraints à la Gertler and Kiyotaki (2010) and are subject to the

possibility of costly default.

We calibrate our model to the US economy and show that in the

decentralized equilibrium banks borrow more than the socially efficient

level. A macroprudential policy which limits bank leverage reduces the

risk of bank default and improves long-run welfare. In the short run,

“macroprudential-flavored” monetary policy can reduce financial

propagation by financial frictions by affecting bank shadow values while

countercyclical capital requirement is effective in stabilizing asset

prices. Our normative analysis shows that introducing countercyclicality

in bank capital requirement achieves only moderate welfare improvement

when monetary policy has been used to mitigate financial acceleration.

The jointly optimal policies suggest that policymakers should assign

countercyclical macroprudential role to monetary policy, and bank

capital requirement should focus on the level of prudence.